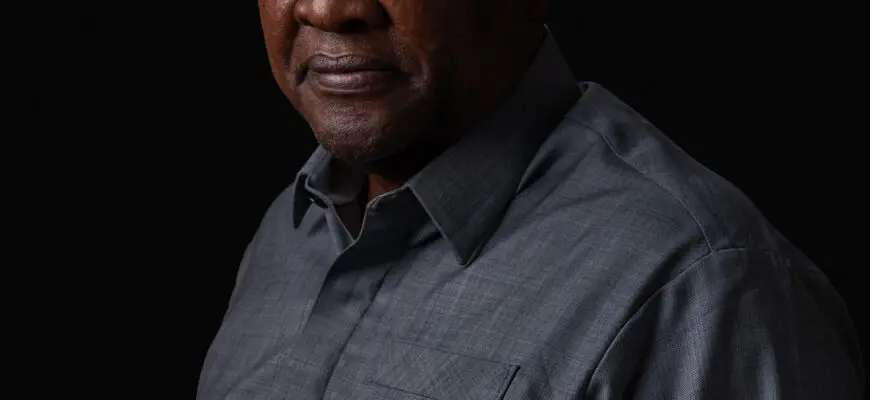

Ghana President John Mahama maintains an outspoken critical stance on global affairs even as he works to stabilize his nation’s economy and push the African continent toward self-reliance. Despite facing strong diplomatic pushback, Mahama insists that the recent sharp reduction in foreign aid serves as a necessary catalyst for African autonomy.

“It will get me into trouble again!” laughs President John Mahama upon the conclusion of our interview. This comment follows a diplomatic incident triggered by an op-ed he wrote for the U.K. Guardian newspaper, in which he “eruditely excoriates” U.S. President Donald Trump’s claims of a white genocide in South Africa and called his “unfounded attack” on President Cyril Ramaphosa “an insult to all Africans.”

“They asked, ‘Did your President actually write this?’” Mahama tells TIME in his presidential office within Accra’s Jubilee House. His Foreign Minister, who faced the U.S. State Department over the piece, responded: “Yes, my President is a writer and likes to express himself.” The U.S. officials’ reply: “Well, he’s President now. Can you ask him to put his pen down?”

Mahama is unlikely to put his pen down or stop speaking his mind. On Sept. 25, the 66-year-old used a speech at the U.N. General Assembly to accuse its Security Council of exercising “almost totalitarian guardianship over the rest of the world,” while demanding an African member be added and the abolition of the veto power. “The future is African!” he proclaimed to rapturous applause.

This confidence is underpinned by strong demographics and economic forecasts. By 2050, over 25% of the world’s population is expected to be African, including a third of those aged 15 to 24. Africa’s combined GDP, which stood at $2.6 trillion in 2020, is projected to reach $29 trillion by 2050. The continent also hosts three of the world’s 20 fastest-growing tech hubs, led by Nigeria’s Lagos.

While Africa’s trajectory is clear, the ascent is challenging, as Ghana’s recent history demonstrates. The West African nation of 34 million has long been viewed as a continental success story for its democratic and economic stability. However, when Mahama returned for a second nonconsecutive term in January, his homeland was embroiled in an acute economic malaise marked by a huge debt burden, soaring costs, and staggering youth unemployment at 38.8%.

In just six months, Mahama succeeded in restoring stability: halving inflation and strengthening the national cedi currency by 30%. He immediately embarked on a radical “Resetting Ghana” agenda, which included:

- Rolling out a 24-hour economy to allow businesses and public institutions to operate around the clock.

- Abolishing burdensome levies on online purchases and betting wins.

- Establishing a code of conduct for all government officials to fight corruption.

- Pledging to wipe fees for all first-year students in public tertiary institutions.

- Distributing free feminine hygiene products to school-age girls nationwide.

- Unveiling plans to train one million coders over four years to bolster the nascent tech sector and fight joblessness.

“We must improve security to make sure that the streets are safe for people to be able to go to work and come back,” says Mahama. “So we know what our responsibilities are.”

The Shock of Aid Cuts

Less than three weeks after Mahama’s Jan. 7 inauguration, the Trump Administration began gutting USAID. This was an almighty curveball, as the agency had allocated $12.7 billion to sub-Saharan Africa, accounting for 0.6% of the region’s GDP.

The consequences are dire: the Pretoria-based Institute of Security Studies estimates the cuts could push 5.7 million more Africans into extreme poverty by next year. The Africa Centre for Disease Control and Prevention estimates that two to four million additional Africans are likely to die annually due to reduced global aid budgets. Cuts to HIV/AIDS programs in South Africa alone could result in an additional 500,000 deaths over the next decade.

Ghana lost $156 million allocated for HIV and AIDS control, malaria combatting, research, governance, and education. Still, Mahama calls the cuts “not fatal.” “All I did was to tell our Finance Minister to make adjustments … so we have covered it with our budget. We’re fine, but not so in some other countries. I was speaking to one of my colleague presidents and the USAID withdrawal has shut down their school feeding program. With countries like that, it will have quite a huge effect.”

Mahama’s term coincides with a new paradigm for Africa. Despite vast agricultural and mineral wealth, the continent faces limited access to global markets, unfair trading conditions, and a lack of investment. The hope is that the decline of foreign aid serves as a rallying call, compelling African countries to forge their own paths, free from aid dependency and external policy pressures. “Ghana will manage,” says Mahama. “And it teaches us to be self-reliant.”

The Problem with Aid

Mahama talks with an unruffled, languid poise that belies the candor of his words. His political perspective was perhaps shaped by his experience pursuing a post-graduate degree in social psychology in Moscow, graduating in 1988 amid the Soviet Union’s death throes, reinforcing the belief that every nation must forge its own distinct path.

Mahama’s first term as president, from 2012 to 2017, was underwhelming, marred by a severe power crisis and corruption allegations (including receiving a $100,000 Ford Expedition from a contractor while serving as vice president, though he was later cleared of graft). GDP dropped from 9.3% to a low of 2.1% in 2015. Although growth recovered to 8.1% by 2017, voters denied him a second term. However, his successor fared worse, plunging Ghana into an economic crisis that led to a default on domestic and foreign debt obligations in 2022.

Mahama has quickly steadied the ship, a success made more impressive against the backdrop of aid cuts. The problems inherent in aid culture are well-documented. Bright Simons, head of research at the IMANI Centre for Policy and Education, an Accra-based think-tank, notes that only a tiny fraction of aid reached African stakeholders, with the majority going to Western contractors and consultants. “Africans were never able to build capacity with this money,” he says.

Furthermore, foreign aid short-circuits the relationship between citizens and government by making governments accountable to donors rather than constituents. This easy access to cash also fosters corruption; an estimated $88.6 billion—3.7% of Africa’s GDP—leaves the continent annually as illicit capital flight.

“Aid engenders laziness on the part of the African policymakers,” writes Baroness Dambisa Moyo, a Zambia-born economist in Dead Aid: Why aid is not working and how there is another way for Africa. “This may in part explain why, among many African leaders, there prevails a kind of insouciance, a lack of urgency, in remedying Africa’s critical woes.”

This criticism is now widely accepted. Zambia’s President Hakainde Hichilema described the USAID cuts as a “long overdue” wake-up call. While Mahama laments how the aid Band-Aid was ripped off, he believes the end result will be positive, even if it highlights shifting U.S. priorities.

Geopolitical Tensions and Trade

Aside from the aid withdrawal, the Trump Administration has hiked tariffs across Africa, including 15% on Ghanaian exports. Mahama cannot hide his frustration with this nativist pivot.

“One country cannot say, ‘I want to be an island by myself, so I’ll slap tariffs on you because I want to bring manufacturing back,’” says Mahama. He breaks off in exasperation. “I don’t think it’s a very effective way of conducting foreign policy.”

The aid cuts and tariff hikes undermine U.S. soft power, creating an opening for other players. USAID was founded in 1961 precisely to counter Soviet influence, and today, the U.S. is embroiled in a new Great Power competition with China. Mahama says the U.S. posture “takes away U.S. soft power and opens up for other players to come in.”

Other nations are capitalizing on the opportunity. London Mayor Sadiq Khan, during the first African trade mission by a holder of his office, visited Ghana, Nigeria, and South Africa. He stressed the importance of encouraging talented international students to come to British universities “at a time when President Trump is attacking international students.”

The U.S. denies it is in retreat. The State Department highlights over 100 American companies operating in Ghana, and Google recently launched an Artificial Intelligence Community Center in Accra. Rolf Olson, Chargé d’Affaires ad interim at the U.S. Embassy in Accra, insists Washington is ready to partner with Mahama in combating illegal gold mining, which he claims “has been fed by foreign actors, including Chinese firms and nationals.”

Mahama, however, does not share this adversarial tone, noting that “the Chinese government has been supportive” of law enforcement efforts. The Washington preoccupation with Beijing makes the new U.S. posture “surprising,” Mahama says. “I can understand U.S. insecurity when it comes to China … but that’s when you need your allies. Collaboration would have been better than the current global tensions.”

While China is ramping up investment through its $1 trillion Belt and Road Initiative, it is unlikely to replace U.S. engagement wholesale. Beijing focuses on infrastructure (ports, pipelines, railways) but lacks the capacity-building engagement that USAID provided—funding projects related to gender equity, affirmative action, or training impartial judges.

The challenge for Africa is achieving true autonomy without structural transformation. Because domestic resources are often consumed by unsatisfactory necessities (substandard education, healthcare, security), future-focused projects—such as green transition, incorporating AI, and media literacy—tend to be funded by donor agencies. For instance, USAID was a major investor in eco-tourism in Ghana to provide alternative livelihoods and discourage illegal mining.

“So even though the overall amount of aid is small, when you remove it you create a very big gap in that future-rented segment of the country’s structural transformation,” says Simons of IMANI. “The future does not often appear as essential because we are so focused on the present. But the present cannot take us anywhere.”

Forging a Path to Financial Sovereignty

The issue is how to inject capital without falling prey to the pitfalls of aid dependency. With commodity prices at record highs, Africa’s natural resource endowments are a primary focus. Freed from the client-benefactor relationship, African nations are now insisting upon local processing and refining to retain more of the downstream benefits.

Marcus Courage, CEO of Africa Practice, a business consultancy, notes that for decades, Western largesse put African nations in an awkward spot where they had to “play polite” while their resource sovereignty was diluted. “Now, African governments have recognized that they have more autonomy and must use it to become more self-reliant and to achieve genuine financial sovereignty.”

- Guinea, the world’s top bauxite exporter, now mandates that foreign mining companies invest in local alumina refineries; non-compliant firms have seen licenses withdrawn.

- In Ghana, the nation’s first commercial gold refinery opened in August 2024. Mahama launched a new regulator, GoldBod, to crack down on smuggling and boost state revenues. Gold exports have increased 75% year-on-year as a result. “It means that Ghana is able to get more from its gold resources,” says Mahama.

Technology offers further hidden potential. Africa is home to 60% of the planet’s uncultivated arable land, capable of sequestering immense amounts of carbon, yet it accounts for only 16% of the global carbon credits market. This presents an untapped opportunity for nations to monetize mature forests and pristine wetlands, which are highly prized for carbon capture. The Congo Basin rainforest, for example, removes carbon with a value of $55 billion per year, equivalent to 36% of the GDP of the six countries that host the forest.

Ghana has 288 forest reserves, 44 of which have been invaded by illegal gold miners. “We’ve been able to liberate nine of them,” says Mahama. “And we have a program for starting a reclamation of those forest reserves to restore them.”

Beyond carbon, technology is emerging to leverage natural resources while they remain undisturbed. The global tokenization of illiquid assets is slated to become a $16 trillion business opportunity by 2030. There is growing demand to use blockchain technology to tokenize commodities such as Ghana’s gold reserves, Botswana’s diamond reserves, and Zimbabwe’s platinum.

While more efficient monetization would provide a shot in the arm, the crucial step is leveraging that windfall to diversify the economy beyond extractive industries. Mahama wants Ghana to move past mining and agriculture into processing and agribusiness, digital services, fintechs, textiles, and manufacturing.

For Mahama, Africa should not just export to developed states but trade with itself. He cites the 2018 creation of the African Continental Free Trade Area (AfCFTA)—the world’s largest free-trade area, comprising a $3 trillion market—as an underutilized opportunity. “Already, we export in limited ways to our West African neighbors,” says Mahama. “But the African Continental Free Trade Area expands us beyond our 34 million population market to a 1.3 billion market.”

Of course, realizing this potential requires investment. While the drying up of no-strings aid money may prove beneficial in the long-term, the lack of alternative finance remains a problem. While self-financing is the ultimate goal, it will be a long road. African nations collective